In a significant move aimed at championing the well-being of the Filipino populace, the Bureau of Internal Revenue (BIR) has, through Revenue Memorandum Circular No. 17-2024, granted a reprieve to those battling critical ailments. As of the January 31, 2024, announcement, the BIR has decided to exempt 21 crucial medicines from the clutches of value-added tax (VAT).

The updated list is also accessible at the Food and Drug Administration (FDA) Verification Portal. This may be found at https://verification.fda.gov.ph under “VAT-Exempt Health Products”.

A Boon for Health and Finances

The tax relief extends to medicines addressing a spectrum of health concerns, including cancer, diabetes, hypertension, kidney disease, mental illness, and tuberculosis. This compassionate initiative is rooted in the Food and Drug Administration’s (FDA) endorsement, an arm of the Department of Health (DOH). The FDA’s recommendation prompted this strategic move by the BIR, aligning with the provisions of Republic Act No. 10963 (TRAIN) and RA 11534 (CREATE).

Health Secretary Ted Herbosa expressed his enthusiasm for this development, emphasizing the positive impact on those grappling with illnesses. “I welcome that kasi nga [because] these are drugs that are needed by people who are really sick. So, the VAT exemption is very important because it lowers the price of medicines,” he remarked during an ambush interview.

Affordable Medicines, Expanded Healthcare Reach

With the removal of VAT from these essential drugs, the BIR aims to alleviate the financial burden on patients and bolster the overall healthcare system. Secretary Herbosa articulated the potential ripple effect, stating, “One of the things I want to do in primary care is to make medicines more available. And if the medicines are cheaper, more people could be given such through the budget that the Congress gives me.”

This laudable decision aligns with the BIR’s commitment to excellent taxpayer service in 2024. Internal Revenue Commissioner Romeo Lumagui Jr. emphasized this commitment, stating, “Excellent Taxpayers Service will be the focus of BIR this 2024. This includes the issuance of circulars that would ease the financial burden of Filipinos that are suffering from the said diseases.”

The Gift of Relief in the New Philippines

Lumagui encapsulated the essence of this tax exemption as a gift to the “Bagong Pilipinas” (New Philippines), highlighting the swift and reliable service that the BIR aims to provide. “Ito ang handog ng BIR sa Bagong Pilipinas, serbisyong mabilis at maaasahan. Ito pong 21 na gamot na tinanggalan ng VAT ay simula pa lamang ng mga serbisyong aming ibibigay ngayong 2024,” he added.

This compassionate initiative not only marks a positive stride in healthcare accessibility but also stands as a testament to the BIR’s commitment to contributing meaningfully to the well-being of the nation. The removal of VAT on these 21 medicines serves as a beacon of hope, ensuring that health and healing are not hindered by financial constraints. As we step into the new era, the BIR’s dedication to service shines brightly, promising a healthier, happier Philippines for all.

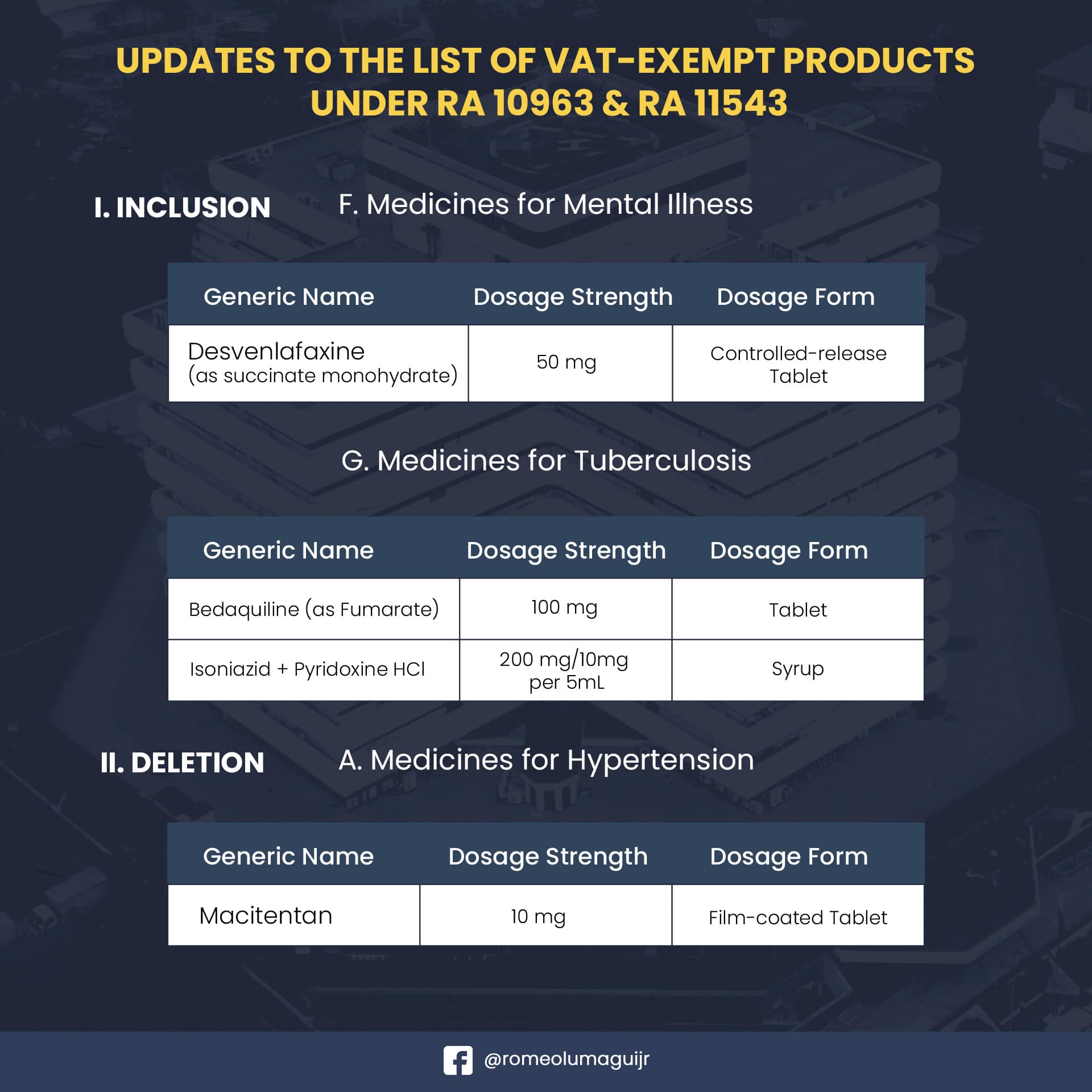

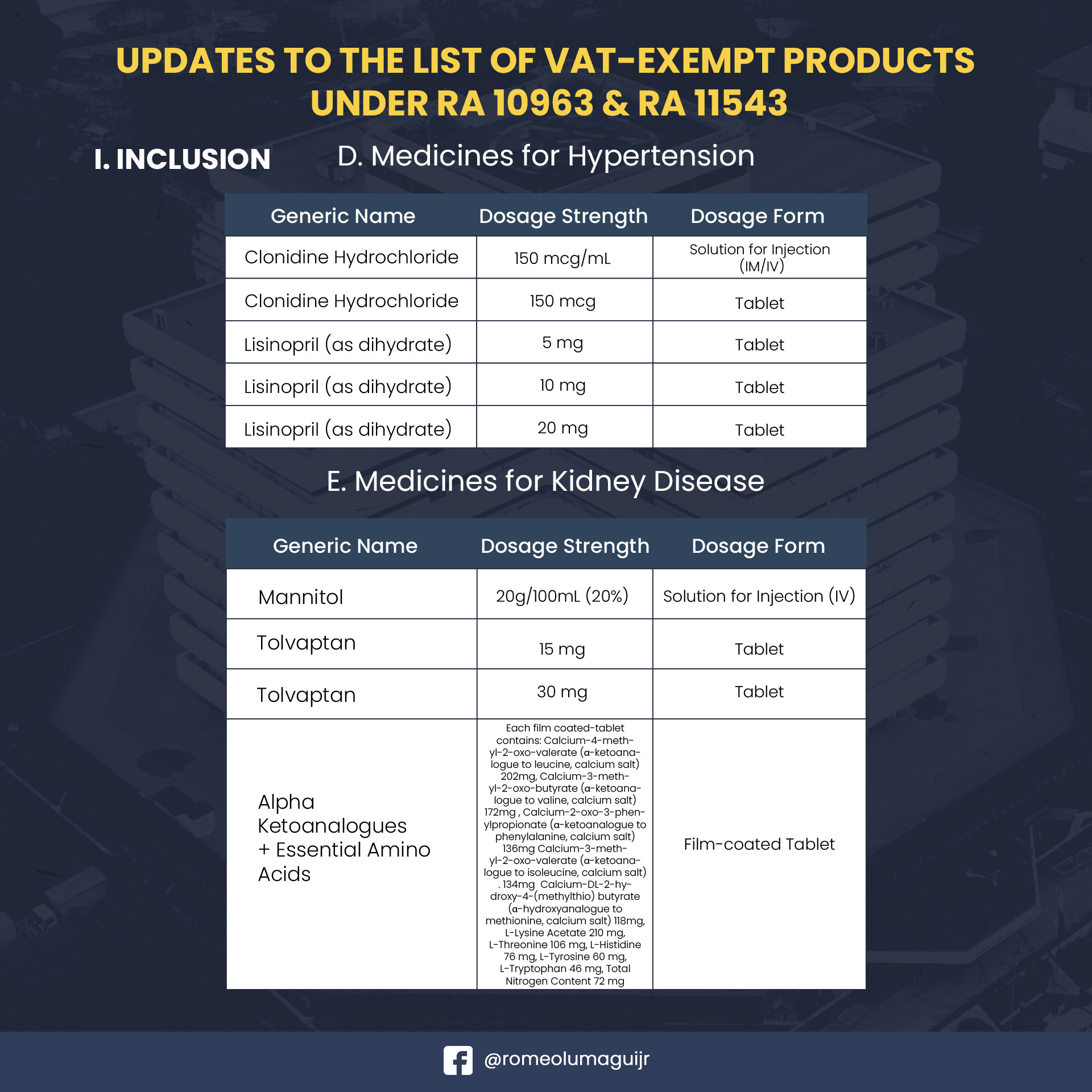

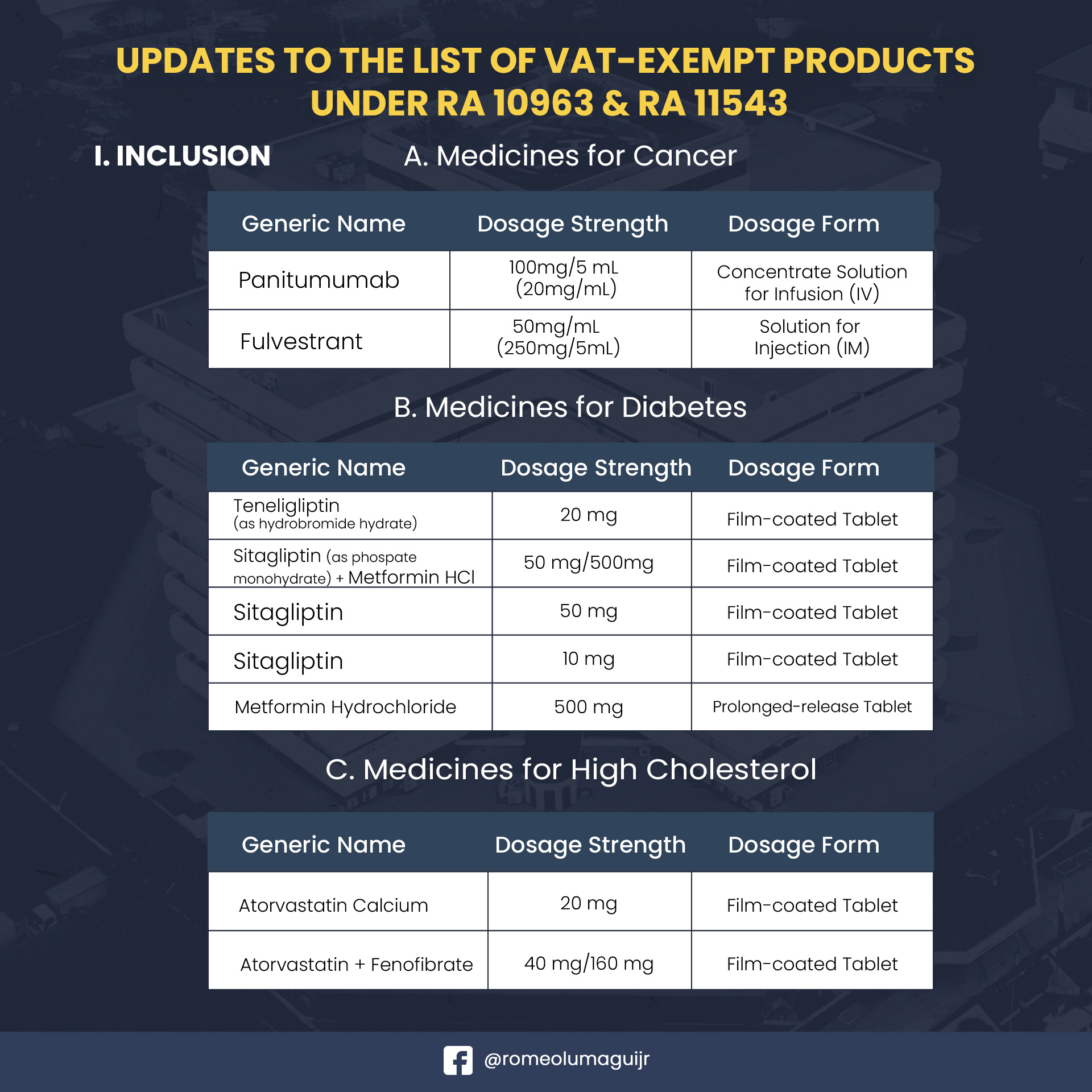

VAT-Exempt Medicines List (Section 109(AA) of the National Internal Revenue Code of 1997, as amended by TRAIN Law and CREATE Act):

Note: For a detailed overview, click here to the official circular or contact the BIR.