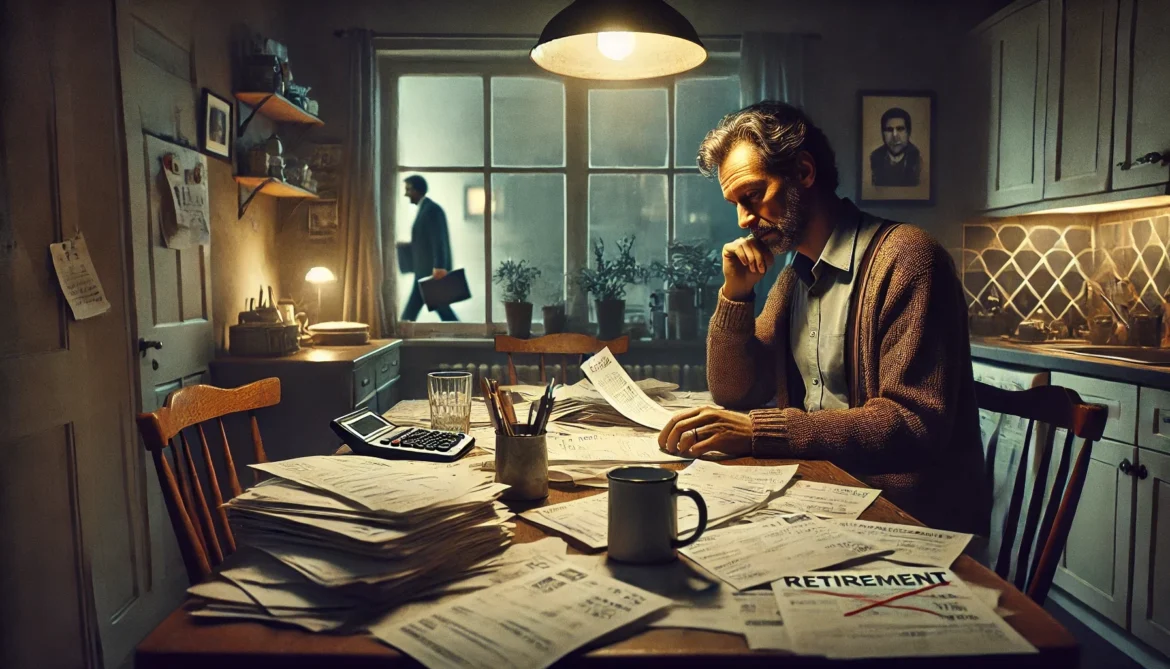

If you’re in your 40s or 50s and constantly worry about your financial future, you’re not alone. Many of us belong to what experts are calling the “lost generation” — middle-aged workers who are grappling with pension anxiety due to unstable careers, poor retirement planning, and economic upheavals over the last few decades.

This blog explores the causes of pension anxiety, the factors contributing to our sense of financial insecurity, and what can be done to find some peace of mind.

What Is Pension Anxiety?

Pension anxiety is a growing phenomenon among people in their mid-life years who are deeply worried about not having enough retirement savings. It’s more than a passing concern — it’s a persistent stress that affects mental health, work performance, and even personal relationships.

For many in their 40s and 50s, the traditional path to a secure retirement feels increasingly out of reach.

Why the ‘Lost Generation’ Feels Left Behind

There are several reasons why middle-aged individuals are experiencing heightened levels of pension anxiety:

- Economic Instability: From the 2008 financial crisis to the COVID-19 pandemic, economic shocks have severely disrupted long-term financial planning.

- Housing and Living Costs: Skyrocketing housing prices and the rising cost of living make it difficult to allocate funds toward pensions.

- The Gig Economy: Many of us have worked freelance or short-term contracts without access to employer pension contributions.

- Poor Financial Literacy: A lack of guidance on retirement planning has left many unsure of how much to save or where to invest.

- Later Start to Saving: Millennials and Gen Xers often started saving much later than Baby Boomers, putting them at a disadvantage.

The Mental Health Toll

Pension anxiety doesn’t just affect your bank balance — it takes a serious toll on mental well-being. Feelings of guilt, inadequacy, and fear about the future can become overwhelming. Many feel shame in not having their finances “together,” which can lead to isolation and depression.

What Can Be Done?

While the situation is serious, it’s not hopeless. Here are some steps that can help alleviate pension anxiety:

- Assess Your Current Financial Position

Take a realistic look at your current savings, debts, and retirement needs. Use pension calculators and budgeting tools to get a clear picture. - Consult a Financial Advisor

Professional advice can help create a tailored plan and uncover saving and investment options you might not be aware of. - Maximize Pension Contributions

Whether it’s a workplace pension or a private one, increase contributions if possible. Small changes now can make a big difference later. - Explore Side Income Options

Freelancing, part-time work, or passive income streams can help supplement savings. - Start Now – It’s Never Too Late

Even if you’ve started late, taking action today is better than waiting. Compound interest and consistent saving can work in your favor over time.

A Generational Wake-Up Call

The pension crisis facing our generation is a wake-up call — not just for individuals but for society. We need better education, employer support, and government policies that address the real financial challenges people in their 40s and 50s face today.

Conclusion: You’re Not Alone

If you’re suffering from pension anxiety, remember you’re part of a growing community. The key is to face the issue head-on, seek help, and take small, consistent steps toward a more secure financial future.